huntsville al sales tax registration

The December 2020 total local sales tax rate was. The Alabama Legislature amended this law to include county and municipal sales and use tax on boat purchases effective on and after July 1 1994.

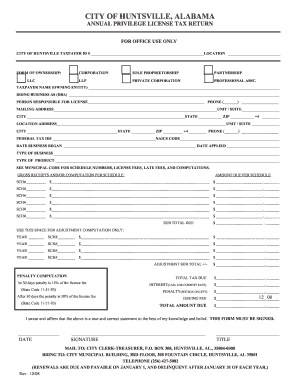

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

1-800-870-0285 email protected Sign In Business Location AL Madison Huntsville Park Tax Registration Modify Search.

. To transfer a vessel without current registration into a new owners name and renew registration an. Sales Tax is imposed on the retail sale of tangible personal property in Huntsville. Learn more and apply for a tax account number for select tax types.

Ad New State Sales Tax Registration. Your out-of-state registration if available must be presented with the application. Tobacco tax is imposed on the sale or distribution of tobacco products within Huntsville city limits Wholesale Wine Tax Rate A wine tax is levied by the State to be paid directly to the City.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. The 9 sales tax rate in. Miles Madison County Tax Collector.

Once you register online it takes 3-5 days to receive an account number. These taxes are used to support Huntsville citizens and are paid by everyone who shops in Huntsville. 1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760.

We Represent Integrated Network of Tax Agencies All Over the World. If you have questions give us a call at 256-532-3370 or email. 58 percent of the city of Huntsvilles budget is based on sales taxes.

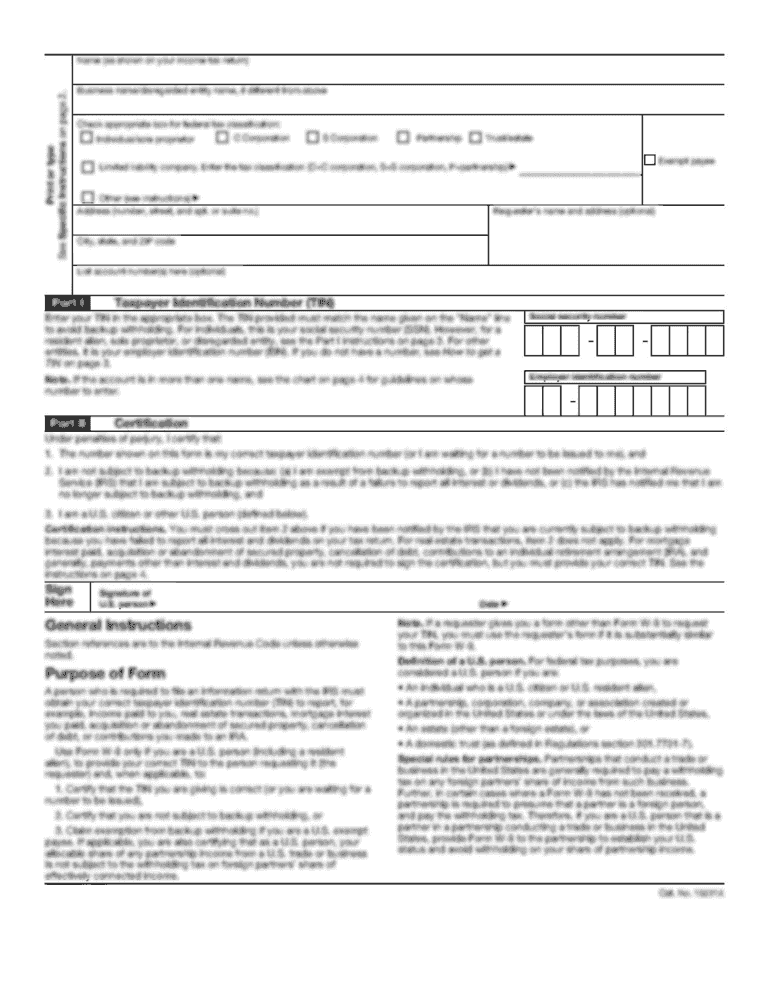

In addition to start your own Online Clothing Sales business the first step is to apply for a AL Home Occupation Business License Madison County Occupational Business License. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Ad New State Sales Tax Registration.

1002 remainder sales tax m ax discount 400 5 nettax due item 1 - item4. The Tax Lien Auction and Sale process is New for Madison County. Information needed to register includes.

Type of business entity. MADISON COUNTY SALES TAX DEPARTMENT MADISON COUNTY COURTHOUSE 100 NORTHSIDE SQUAR E HUNTSVILLE AL 35801 IF YOU HAVE ANY. This is the total of state county and city sales tax rates.

A sales tax license can be obtained by registering through the My Alabama Taxes website. Find 16 classic cars for sale in huntsville al as low. Huntsville AL Sales Tax Rate Huntsville AL Sales Tax Rate The current total local sales tax rate in Huntsville AL is 9000.

For use if any of the following apply. 100 North Side Square Huntsville AL 35801 Physical Address. 8 rows Sales Tax.

Reporting period fromto taxpayer name address. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. What is the sales tax rate in Huntsville Alabama.

Huntsville collects and administers the following. Sales reps or employees soliciting business in Huntsville. MAIL COMPLETED APPLICATION TO.

Business Tax Online Registration System. State sales and use tax on vehicle purchases is 2 of the net purchase price. If delinquentitem 1 item2 total amount due account no.

A Huntsville Alabama Tax Registration can only be obtained through an authorized government agency. Real property tax on median home. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact.

However pursuant to Section 40-23-7 Code of. Depending on the type of business where youre doing business and other specific. Alabama Tax Sales information registration support.

Annual Ad Valorem Tax. Businesses should complete a simple tax account registration form with the City to receive an account number for reporting purposes. This is the total of state county and city sales tax rates.

Our Experienced Highly Qualified Team is Ready to Help. Alabama Tax Sales information registration support. Ad Sales Tax Registration Services.

Business License Annual Tax Return. The minimum combined 2022 sales tax rate for Huntsville Alabama is. Simplify the sales tax registration process with help from Avalara.

Sales tax is collected by the seller from their customer. Sales Affiliates and Partnerships. Access detailed information on sales tax holidays in Alabama.

Sales Tax State Local Sales Tax on Food.

Filing An Alabama State Tax Return Things To Know Credit Karma Tax

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

How To Figure Up Car Taxes In Huntsville Alabama Ozark

Alabama Sales Tax Guide For Businesses

Tax Filing Help For Seniors Rocketcitynow Com

![]()

South Huntsville Main Business Association Archives Huntsville Business Journal

What Is The Auto Sales Tax In Madison County Alabama Ozark

Madison County Sales Tax Department Madison County Al

Madison County Sales Tax Department Madison County Al

Tax Filing Aide Available For Huntsville Area Seniors

New Ram 1500 Trucks For Sale In Huntsville Al Landers Mclarty Dcjr

Madison County Sales Tax Department Madison County Al

Tax Levies In Madison County Madison County Al

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Huntsville Vehicle Sales Tax On Car Purchased In Sc R Huntsvillealabama

Huntsville Approves 320 Million Incentive Package For Toyota Mazda Plant Al Com