november child tax credit schedule 2021

Up to 3000 for each child age 6-17. IR-2021-222 November 12 2021.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Four payments have been sent so far.

. The Child Tax Credit provides money to support American families. These people are eligible for the full 2021 Child Tax Credit for each qualifying child. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

New York City credits. To opt in to receiving the advance CTC in December youll need to file your 2020 tax returns by Nov. Ad Tax Strategies that move you closer to your financial goals and objectives.

File a federal return to claim your child tax credit. The schedule of payments moving forward will be as follows. Low-income families who are not getting payments and have not filed a tax return can still get one.

Form 1040EZ is ineligible for the federal tax credit. The tool also allows users to add or modify bank account information. Children must be under age 13.

New Yorkers can expect to receive their checks by the end of October. Married couples filing a joint return with income of 150000 or less. If your or your childs SSN or ITIN was issued after the due date of the return you may claim only 100 per qualifying child.

You will need to file Form 1040 Form 1040A or Form 1040NR. The opt-out date is on November 1 so if you think it may be. We provide guidance at critical junctures in your personal and professional life.

Here is some important information to understand about this years Child Tax Credit. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

What To Do If The IRS Child Tax Credit Portal Isnt Working. File a 2021 tax return to claim the CTC. If you got advance payments of the CTC in 2021 file a tax return in 2022 to claim any remaining CTC payment that is owed to you.

Credit a non-refundable tax credit of up to 2100. The IRS will soon allow claimants to adjust their income and custodial. Children must be under age 13.

2 days agoThe New York Department of Taxation and Finance will soon begin sending direct financial assistance to 175 million New Yorkers who received the Empire State Child Credit andor the Earned Income Credit on their 2021 state tax returns. Are you a full- or part-year New York City resident. Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. That depends on your household income and family size. This is a good idea anyway since failing to file can result in penalties if you.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. You may qualify for New York State Child and Dependent Care Credit a refundable tax credit of up to 2310. Simple or complex always free.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. Up to 3600 for each child age 0-5. If you did not claim the federal child tax credit but meet all of the other eligibility requirements shown above the amount of the Empire State child credit is.

Families with a single parent also called Head of Household with income of 112500 or. Its part of the larger Mesoamerican Barrier Reef System that stretches from Mexicos Yucatan Peninsula to Honduras and is the second-largest reef in the world behind the Great Barrier Reef in Australia. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

For the 2021 tax year the CTC is worth. The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

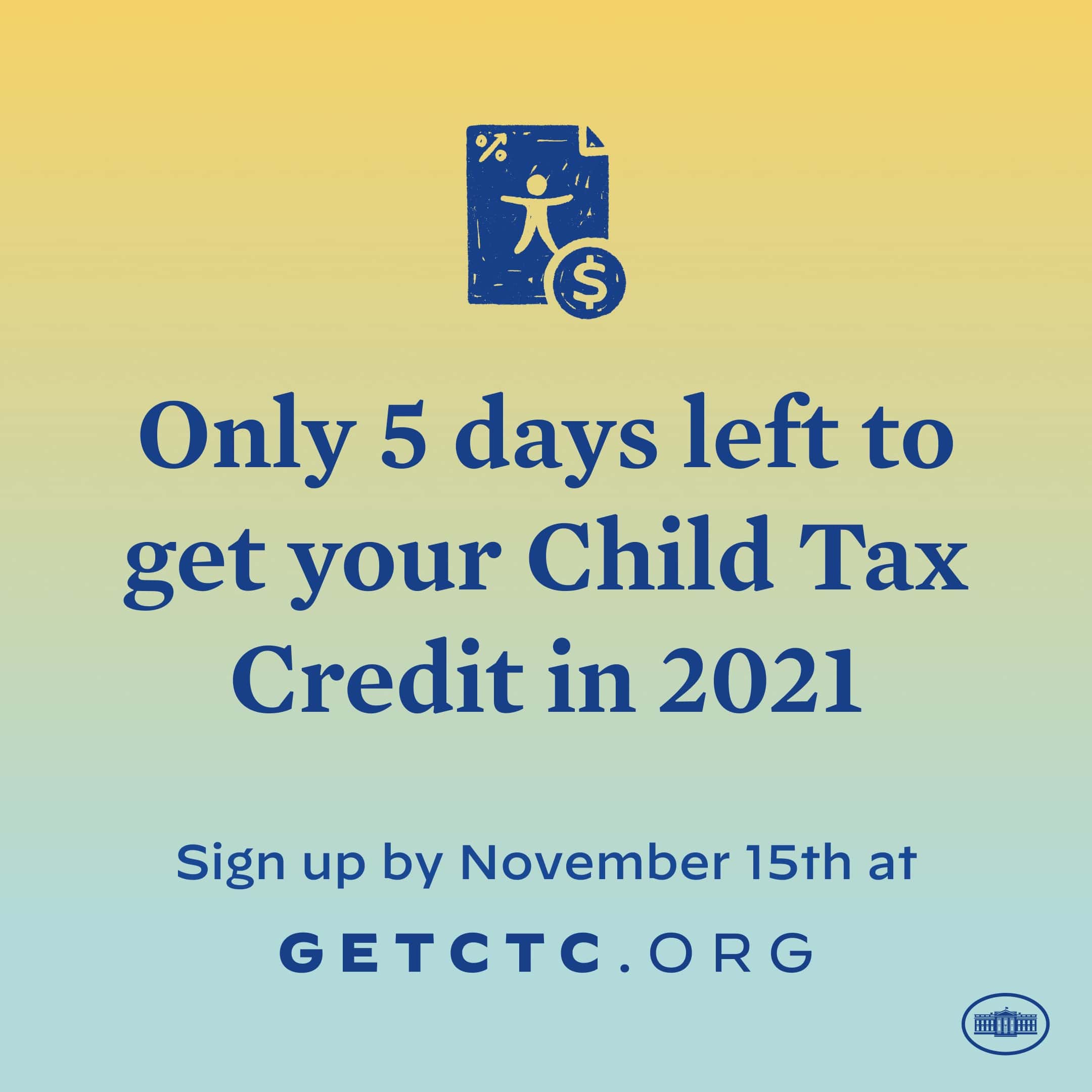

July August September and October with the next due in just under a week on November 15. New York State offers several New York City income tax credits that can reduce the amount of New York City income tax you owe. 100 multiplied by the number of qualifying children.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Advanced Payment Option Tas

The Child Tax Credit Toolkit The White House

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Childctc The Child Tax Credit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Did Your Advance Child Tax Credit Payment End Or Change Tas

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox